Happy Sunday! Anyone have advice on first time car buying? In December my lease is up for my Honda, and I'm thinking about just doing a lease again even though I promised myself I wouldn't. However, we are getting married in March and moving with the military for shore duty (no idea until a month prior) in the summer of 2018. I got some estimates from Hyundai and other places and with my newly established credit and such I cannot foresee myself paying what I've been quoted. Yes, buying a used car in an option but I'm skeptical about that. Any suggestions?

Post content has been hidden

To unblock this content, please click here

Related articles

Married Life

Looking for Happily Ever After? Experts Share How to Make a...

These seven principles are the roadmap to a happy marriage.

Family & Friends

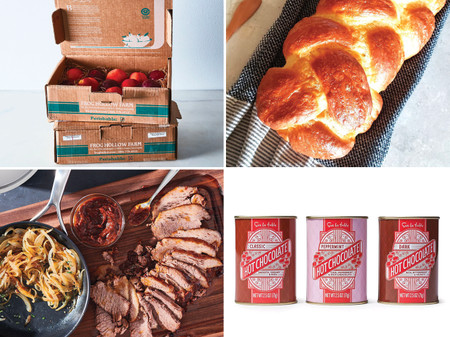

30 Adventurous Food Gift Ideas for Couples Who Love Trying...

Shopping for a special couple? These food- and drink-themed presents will wow...

Lifestyle

31 Anniversary Gift Ideas to Celebrate 10 Years of Marriage

It's been a decade since the "I do"s—honor the occasion with these thoughtful...